|

Keeping track of payments, expenses, and making sure your business accounts stay afloat can be a daunting task when you’re just starting out. I love using YNAB “You Need A Budget” budgeting software to help me manage my businesses finances. This user-friendly software has made it really easy to keep track of my outflows and inflows, set aside money for upcoming expenses, and keep my businesses operating in the black. Here’s how I use YNAB for my business.

This post may include affiliate links in which we earn a small commission without any additional cost to you. All opinions are our own.

1) Keep Track of Expenses

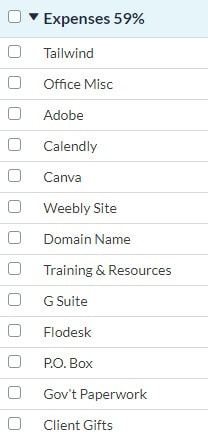

When it’s time to write out your profit and loss statement, what do you use to keep track of your expenses? If you’re relying on your memory or random bank statements, you might be missing key data. Keeping track of your expenses accurately can save you money during tax time. Every time I make a purchase for my business, whether that’s paying for a service, buying office supplies, or subscribing to software, I keep track of that in YNAB. No matter which account I used to pay for it, I can keep an eye on all my expenses and know exactly where my money is going. I love that in YNAB I can name my own categories so I can keep track of how much I’m spending in each category.

My budget categories for my business budget is really specific: 2) Keep Track of Income

In business you’ll have money coming in through different resources. You might have money coming in through Stripe, Paypal, Etsy, affiliate payouts, and royalties in all the same business. When you have income coming in through different companies and avenues, you can’t rely on one single dashboard to see your whole business. Using a software like YNAB keeps track of the income you’re actually getting, it’s not vanity numbers. On a lot of platforms like Amazon, Poshmark, Etsy, they’ll show you the total “revenue” but if you try to use that number to plan and budget, you’ll always be falling short because those numbers are pre-fees. I keep track of all my income by recording transactions from my bank account in YNAB so I can see how much money I’m actually dealing with. I still need to know my revenue numbers for my taxes, but it doesn’t really help me in terms of handling my day to day finances.

3) Set Aside Money for Taxes

As I previously mentioned in an other blog post, as a small business owner I’m responsible for my own taxes. I set aside 15% of my inflows in a separate category in my YNAB budget. I don’t touch those taxes until I get my annual tax return done. If there is any money left over at the end of the tax year, I give myself a nice little bonus (or use it for a future business improvement). I got the 15% number from Profit First, a great book that helps you manage your business finances. I use the Profit First method alongside YNAB. Profit First says to have 7 different bank accounts to separate your money. Instead, I have 7 master categories inside my YNAB budget and they function the same way.

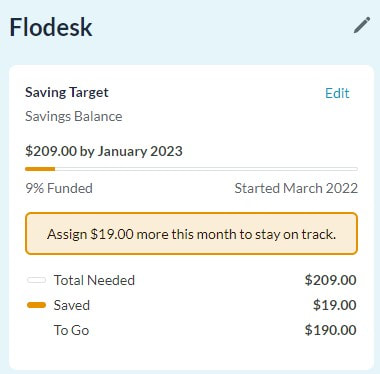

4) Set Aside Money for Yearly Expenses

Not planning for yearly expenses is an excellent way to sabotage your monthly budget. Especially in business, some of those yearly expenses can be quite large. Instead of just having a category of “yearly expenses” I make specific categories named exactly what they are, i.e. Flodesk, Canva, etc. And then I create a goal in YNAB for that specific category. The software automatically tells me how much to set aside each month and if I’m on track to hit my target.

Here is an example of what this looks like for myFlodesk category:

YNAB has improved my personal finances and my business finances. You can have as many budgets as you like within your subscription. I don’t know where my finances would be without it!

Have you tried using YNAB yet? I help women who want to turn their passion into profit take their next steps with clarity and confidence using business planning, strategy, marketing, coaching and accountability. Your first call is free, I’d love to get to know you and your business and see if I’m the right coach for you!

Recommended Next Read

0 Comments

Leave a Reply. |

AuthorHey! My name is Christine and I'm an entrepreneur and small business coach. I've learned most of what I know through trial and error. I help women who are new to business to take their next steps with confidence and clarity. Archives

September 2022

Categories

All

|

Menu |

© COPYRIGHT 2023. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed